Human Capital Strategy for Sustainable Growth:

Empowering Asia Pacific Businesses

As the world grapples with the challenges posed by climate change, businesses across the globe are taking proactive steps to decarbonize their operations and embrace sustainable practices. This shift towards green and socially responsible initiatives is not only driven by the need to mitigate environmental risks but also by the growing demand from investors and consumers for sustainable products and services as well as increasing regulatory requirements.

In this article, we will explore the human capital strategy for sustainable growth in the Asia Pacific region, highlighting the increasing adoption of sustainable finance and the pivotal role of education and certification programs. Additionally, we present a real case that exemplifies a solid human capital strategy for an ecosystem’s sustainable growth.

Asia Pacific’s Advancements in Sustainability Efforts

In the Asia Pacific region, sustainability trends are gaining momentum across sectors such as agriculture, energy, and transportation. In Hong Kong, the trend towards sustainability is evident in various sectors. Green building being one main target for achieving decarbonization, the construction industry has seen a growing emphasis on green building practices, with the adoption of sustainable materials, energy-efficient designs, and green building certifications such as the BEAM Plus.

By January 2023, there were nearly 2,200 registered projects for BEAM Plus assessment. The hospitality sector has been stepping up. A survey by the Hong Kong Hotels Association showed that 70% of respondents have implemented energy-saving initiatives, and 65% have adopted waste reduction programs compared to over 80% of hotels with energy-saving measures, and over 70% adopting water conservation initiatives in Singapore. In the manufacturing sector, many companies are investing in technologies to reduce energy consumption and minimize waste generation to meet the ESG requirements of their foreign customers and stay in their supply chain. In terms of transportation, the Hong Kong government has set a target to achieve zero carbon emissions for all government vehicles by 2030 and aims to have no ICE vehicles on the roads by 2035. Approximately 64.3% of all new private car registrations in the territory in 2023 are electric vehicles.

The upward trend suggests that there is still plenty of room for growth and development across all sectors in the upcoming years.

The Rise of Sustainable Finance in Asia Pacific

Investors are placing more and more emphasis on ESG factors in their investment decisions. A recent survey by PWC shows that 70% of PE firms place value creation among the top 3 drivers for their ESG activities. A third of them incorporate ESG factors into valuation exercises and due diligence. 53% of respondents have chosen not to pursue a deal at least once because of ESG factors.

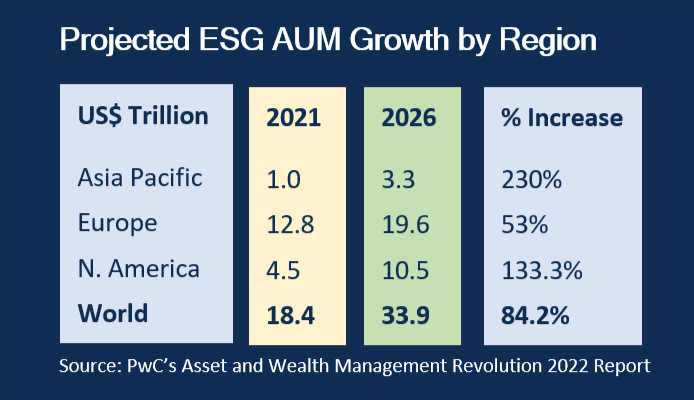

The Asia Pacific region is also witnessing a significant increase in the adoption of sustainable finance practices. ESG AUM is expected to triple in APAC by 2026 (see Box 1 for more details). Green, social, and sustainability (GSS) bonds are gaining traction, with Europe leading the way. It is projected that GSS bonds in Europe could reach Euro 1.4 trillion or more by 2026, indicating the growing interest in sustainable investments.

In Asia, Hong Kong stands out as a Green Finance Hub, with GSS+ bonds, notes, and debt reaching USD 80.5 billion in 2022, accounting for over 9% of the global USD 858.5 billion total. 74% of Hong Kong-listed companies have expressed interest in participating in green finance in the future. This highlights the importance of Hong Kong as a key player in the sustainable finance market.

Corporations that are rated high in sustainability enjoy easier access to capital, lower cost of capital, stronger brand, better talent attraction and retention, and a sound position in the procurement activities of large international customers.

A Chase for ESG Talent

To meet the increasing demand for sustainable practices, organizations of all industries are expanding their sustainability teams. Professional services firms such as EY and PwC are leading the way by investing in their sustainability units. EY aims to triple its current 3,000-strong sustainability unit globally by 2025, while PwC plans to hire 100,000 ESG professionals over five years from 2021. These initiatives not only create job opportunities but also ensure that businesses have the necessary expertise to navigate the complex landscape of sustainable finance.

As Hong Kong aims to become a sustainability hub for the Greater Bay Area (GBA) and ASEAN, the demand for ESG talent is creating a broader talent gap. In Singapore, the increasing demand is said to have increased ESG jobs by 257% over the last 3 years. This hike in demand has also created a higher premium for salaries for ESG professionals.

A comprehensive human capital strategy for sustainable growth is thus instrumental for businesses to build up an effective ESG team and integrate their sustainability strategy throughout the whole company.

In addition to academic programs, certification programs are gaining popularity among business leaders and professionals. Investment analysts are obtaining certifications such as GARP’s SCR, CFA’s ESG Investing, CFA’s Climate, Valuation, and Investing, and the Certified ESG Analyst (CESGA) certificate by the European Federation of Financial Analysts Societies (EFFAS), while engineers are pursuing certifications offered by the Hong Kong Institute of Environmental Professionals (HKIOEP). Board members and business leaders are also seeking certifications in ESG, climate, and biodiversity through programs such as Competent Boards’ designation programs, the Certificate in Sustainability Leadership program offered by the Hong Kong Institute of Directors (HKIoD), and the program offered by Cambridge Institute for Sustainability Leadership.

ESG Education & Certification Programs

Recognizing the need for specialized knowledge in sustainable finance, educational institutions in Asia Pacific are introducing programs tailored to this field. The Hong Kong University of Science and Technology (HKUST) launched a Bachelor’s degree program in Sustainable and Green Finance in 2022, equipping students with the skills needed to drive sustainable growth. The Chinese University of Hong Kong (CUHK) also began a master’s degree program in Sustainable and Green Business in 2023, further contributing to the development of a sustainable workforce.

Finding the Right Talent

As sustainability is a relatively new function, the talent pool especially for senior roles such as Chief Sustainability Officer or Head of Sustainability, which require high-level strategic thinking, is limited and developing. Companies who would want to hire more experienced and strategic heads may need to be open to seeking talent from across industries. For example, the Group Head of Sustainability of Pan-Asia insurance company joined the insurance sector two years ago from a long-term career in the FMCG sector.

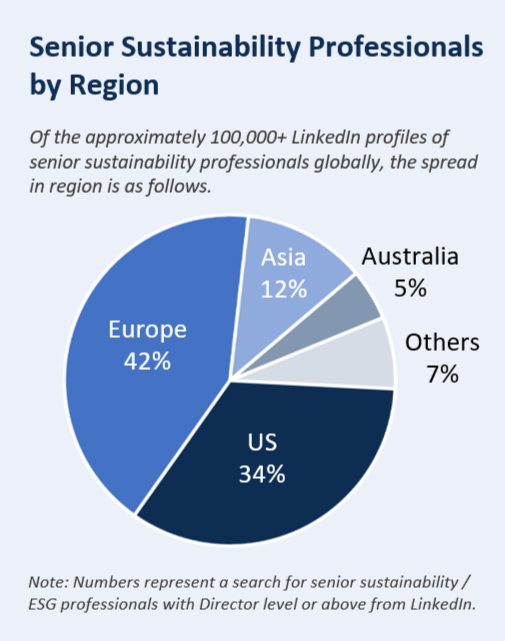

Middle-level roles may require specific technical engineering and industry-specific knowledge. Apart from attracting talent from competitors, companies may need to look to other countries for talent. Singapore has more than double the number of Hong Kong’s sustainability professionals. Australia has 43% of APAC’s sustainability talent.

Upskilling ESG knowledge for existing staff is also a way to ease the pressure. Internal staff have the advantage of industry knowledge and deeper knowledge of the company’s business and culture. The younger generation and millennials usually exhibit a strong passion for social and environmental issues. Providing assistance and financial support for them to acquire relevant ESG knowledge and certification not only helps supply the ESG talent internally, but also demonstrates the company’s commitment to build its ESG human capital which helps to attract and retain talent.

Business Case: CASG's Capacity Building Support for the Banking Industry

(extracted from HKMA SR2022)

The Green and Sustainable Finance Cross-Agency Steering Group (CASG), which is co-chaired by the Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC), coordinates the management of climate and environmental risks to the financial sector, accelerates the growth of green and sustainable finance in Hong Kong, and supports the Government’s climate strategies.

The CASG launched the Centre for Green and Sustainable Finance in July 2021 to coordinate the efforts of financial regulators, government agencies, industry stakeholders, and academia in capacity building and policy development, and to serve as a resource and data repository.

To support capacity building for the industry, the Centre helped the government launch in December the Pilot Green and Sustainable Finance Capacity Building Support Scheme, which provides subsidies to market practitioners, students, and graduates in taking up green and sustainable finance-related training and capacity-building opportunities. Other measures to enhance capacity building include launching the Sustainable Finance Internship Initiative to create more internship opportunities for students and developing a new module on Green and Sustainable Finance under the HKMA’s Enhanced Competency Framework (ECF) for Banking Practitioners. The ECF for Banking Practitioners is developed in collaboration with the banking industry and relevant professional bodies, providing a set of common and transparent competency standards required of the relevant professional areas in the banking sector. The ECF also provides a qualification framework for recognition of those practitioners who have completed the necessary training and assessment, and who have acquired relevant working experience.

Conclusion

As the demand for sustainable practices continues to rise, businesses in the Asia Pacific region are recognizing the importance of developing a strong sustainability / ESG team. Through investments in education, certification programs, and talent acquisition strategies, companies are equipping themselves with the necessary human capital to drive sustainability.

By implementing a comprehensive human capital strategy for sustainability / ESG, businesses can position themselves as leaders in the evolving landscape of sustainable finance and contribute to a more sustainable future for their business as well as for the world.

Co-Authored By:

Agnes K Y Tai, PhD

Governing Board Member,

Climate Governance Initiative

and Director, Great Glory Investment

Corporation

Mava Chan

Associate Director

Global Sage Sustainability & ESG Team

New Partnership to Build Winning Sustainability & ESG Teams for Corporations

Global Sage is a global boutique executive search firm. Established and headquartered in Hong Kong, we have expanded to 11 offices worldwide and pride ourselves on our unwavering commitment to 25 years of excellence in retainer-based search. We have supported clients through our different practices to hire talent for their broader ESG and Sustainability initiatives. To help clients with their ever-increasing demand for ESG talent, we are expanding our offers by partnering with Global Green Connect (GGC), a sustainability ecosystem that provides sustainability consulting services with the passion for helping businesses put sustainability at the operational core of their business and grow it as an asset.

We are here to help our clients build a Sustainability & ESG team.

Our Services:

1. Provide advisory services to companies to shape their Human Capital structure for their sustainability strategy and objectives.

2. Help companies define the job scope of different strategic positions in their sustainability / ESG team.

3. Accelerate the process of finding the right talent from our large database of sustainability and ESG professionals in APAC, our complete pool of Certified ESG Analyst (CESGA) holders, and our network in the financial services and business sectors.

4. Provide companies with sector-based training for their staff.

5. Provide companies and individuals with CESGA exam preparation courses.

Please contact the Global Sage Sustainability & ESG Team:

Ms. Mava Chan, Associate Director

Direct: +852 2872 2585 | Email: mava.chan@globalsage.com

Ms. Triana Siregar, Associate Director

Direct: +65 6221 7933 | Email: triana.siregar@globalsage.com